|

Although the currency of China is officially called Renminbi (in Chinese: 人民币), which literally means "people's currency", people are often puzzled by the currency acronyms of RMB, Yuan, CNY, and CNH. RMB is an abbreviation of Renminbi, and it was first issued in December of 1948 with the establishment of the People’s Bank of China (PBOC in short, the central bank of China). Yuan (in Chinese: 元) is the basic unit of Renminbi, but generally it is also used to refer to the Chinese currency, especially in international contexts where "Chinese Yuan" is widely used to mention Renminbi. The distinction between the terms Renminbi and Yuan is similar to that between Sterling and Pound, which respectively refer to the British currency and its primary unit. One Yuan is subdivided into 10 Jiao (in Chinese: 角), and a Jiao in turn is subdivided into 10 Fen (in Chinese: 分). Yuan is also referred to as “kuài” (in Chinese: 块) in spoken Chinese. The currency sign of Yuan is ¥ (like € for Euro). Renminbi is not yet an international currency because of the Chinese Government's rigid controls. Things have changed. According to the statistics, the usage of Renminbi has expanded by more than 21 times since 2010. Some predict that 28% of China's international trade will be denominated in RMB by the year 2020. Renminbi became the first emerging market currency to be included in the IMF’s SDR basket on 1 October 2016. To prepare for the internationalization of Renminbi, the Chinese Government allows an onshore Renminbi, CNY (a phonetic abbreviation for "Chinese Yuan"), and an offshore Renminbi, CNH. Both CNY and CNH are ISO currency codes. The onshore CNY trading is tightly controlled by PBOC, while offshore CNH is allowed to trade freely on foreign currency markets, with each trading at different rates. However, due to PBOC’s massive influence, CNH’s rate tends to stay within close range of the domestic CNY’s rate. This Credit Insight is an extract from the book Happy Customers Faster Cash, China Edition and on sale at Amazon.

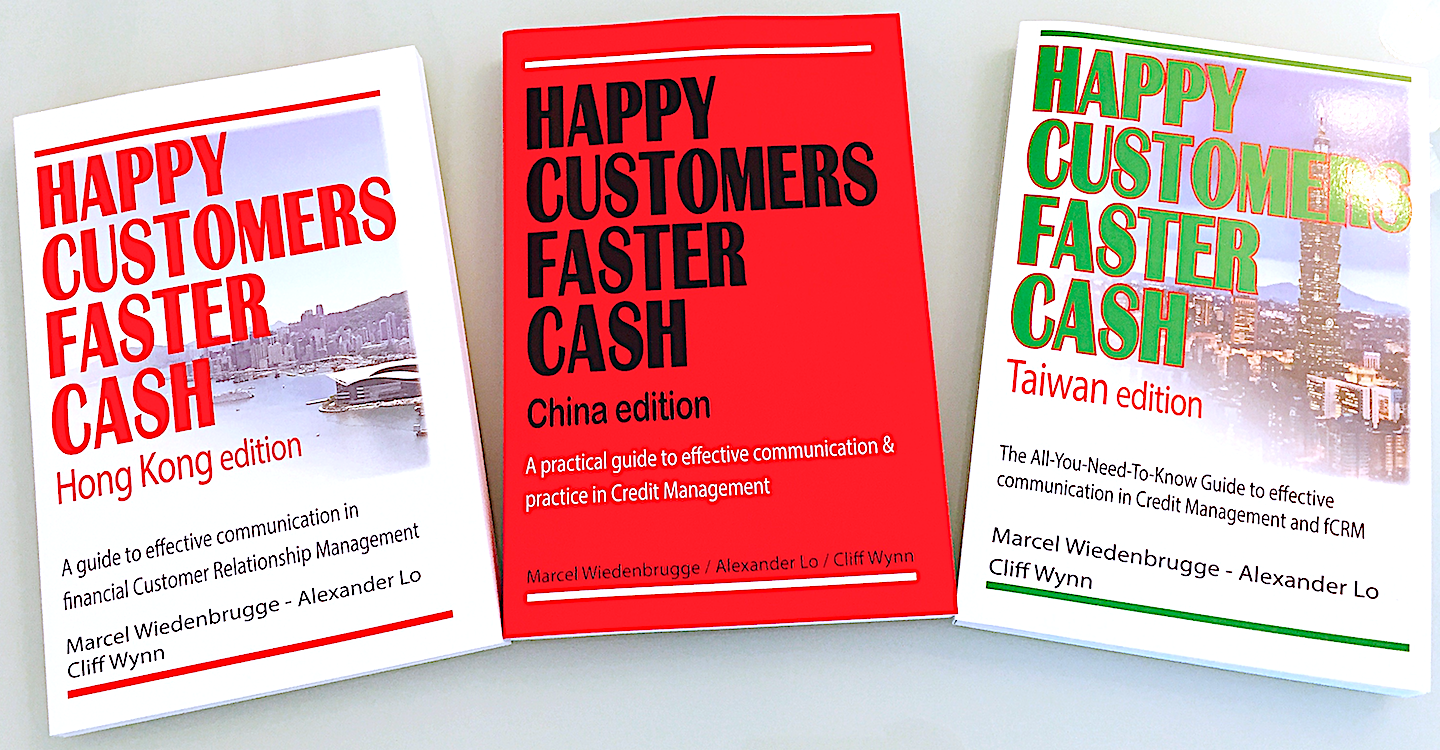

More companies sell on credit to their customers in China. This book shares with you, using statistical data, the true picture of payment behavior in China. It also contains lots of cultural insights for you to better understand the business environment in China. A chapter is dedicated to discuss various aspects of China company credit reports.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAlexander has over 25 years of experience in Business Information Management and Information Technology. Previously, he has held leadership positions in the world’s leading Business Information providers, including Managing Director of Thomson Reuters Asia, and General Manager of Dun & Bradstreet (D&B), Hong Kong and Taiwan. In addition, he personally managed Hong Kong's Commercial Credit Bureau while working with D&B, and the Consumer Credit Bureau through his directorship at TransUnion Limited. Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed