|

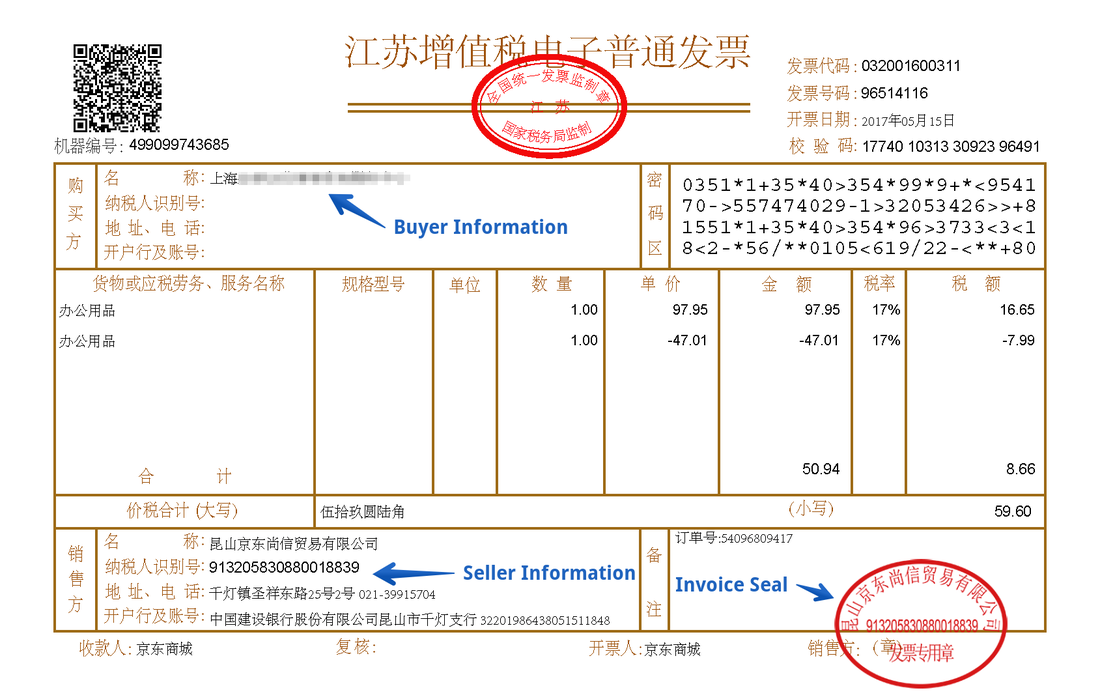

In international markets, an invoice is sent to the customer and inform them to pay according to the agreed payment terms. It is then a voucher used to credit the revenue account and debit the receivable account in the general ledger. When a businessperson comes to China, the meaning of invoice versus “Fapiao” (in Chinese: 发票, literally means invoice) normally generates some confusion. Knowing the difference is important because this is closely related to how you get paid by Chinese customers or handle payment to Chinese suppliers. A Fapiao is used by Chinese tax authorities to calculate and collect business taxes as well as to deter tax evasion. A Fapiao is provided by businesses to consumers or their trading partners for the amount of services or goods rendered much like a receipt. The State Administration of Tax (SAT) prints, distributes, and administers Fapiao. These authorities then require all businesses to purchase the relevant Fapiao, according to their business scope. A Fapiao is also a proof of expense (or cost) if a company wants to claim the expense against its revenue. The Fapiao used for an expense claim must bear the buyer’s company name unless it is exempted under the tax law, such as a taxi or subway Fapiao. Fapiao versus Invoice An invoice (in Chinese: 账单 or 结算单) is a list of goods sent or service provided, with a statement of the sum due for these and the payment terms agreed. An invoice, in general international trade, is issued in the anticipation of a transaction, regardless of its delivery status. A Fapiao should be issued after a payment because it is a hassle to cancel after it is issued (there is a time limit for cancelation). From an accounting procedure’s point of view, a supplier should first issue a payment notice to its customer, and issue the Fapiao after the customer pays. On the contrary, companies nowadays often demand the Fapiao before a payment being processed (i.e. issue a Fapiao before payment). The argument is Starbucks or a taxi driver hands out a Fapiao before a payment is made. Refusal to issue a Fapiao is a violation of the tax law. If a company refuses to issue you a Fapiao, you can report this to the local tax authority. This company will then be subject to prosecution. After a Fapiao is Issued Once a Fapiao is received, the buying company registered in China can immediately use it as a proof of payment (in reality, they may pay 90 days later), and make a tax-deductible purchase/expense entry immediately. On the other hand, the Chinese supplier (the Fapiao issuer) has to bear the revenue tax burden well in advance of payment from its customer. Accounting complications do arise in the event that the actual amount paid is different from the Fapiao amount, or the payment is never received. Fapiao versus Receipt The key differences between a Fapiao and a receipt (in Chinese: 收据 or 小票):

For those interested to know why a Fapiao is also a lottery ticket, refer to the link below to read more: http://thediplomat.com/2013/07/chinas-new-weapon-against-tax-cheats/ Why Fapiao? Fapiao is the Chinese Government's main instrument of controlling taxation in China. In the Western markets, companies issue their commercial invoices, then declare their books at the end of the year, with a proper audit. In China, it happens to control at the point of transaction with the physical issuance of Fapiao. Also, it is harder for a company to evict tax if the Government knows its revenue for sure. Westerners tend to think that business tax is calculated on net profit, while the Chinese Government is keen to tax on revenue because it is easier to implement in history. Indeed, there are distinct types of Fapiao to satisfy different taxation purposes. A search on internet returns many articles but most give an incomplete picture or provide inaccurate information. You are advised to consult a Chinese accounting professional for details. Fapiao & Foreign Companies If you are paying to a Chinese company without a legal entity in China, you may treat a Fapiao as an invoice or a receipt. In general practice, Chinese companies do not issue Fapiao to overseas customers. When a Chinese company pays to a foreign supplier, the Chinese company will not get a Fapiao from the foreign supplier because an overseas company does not have one. In this case, the proper money remittance process, that the Chinese company goes through, will generate a similar official document for it to claim the expense. This Credit Insight is an extract from the book Happy Customers Faster Cash, China Edition and on sale at Amazon.

More companies sell on credit to their customers in China. This book shares with you, using statistical data, the true picture of payment behavior in China. It also contains lots of cultural insights for you to better understand the business environment in China. A chapter is dedicated to discuss various aspects of China company credit reports.

2 Comments

Gordon

10/3/2021 03:18:27 pm

Hi Alexander,

Reply

Alexander Lo

10/3/2021 03:32:40 pm

Just from what you explained, they did not issue you a Fapiao from the "money collector" (the service provider). You should continue to demand why a Fapiao cannot be issued. A Fapiao can be issued to a overseas service buyer; however, you cannot easily use it to claim tax because you don't have a business enitity there. Try go directly to the attorney.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAlexander has over 25 years of experience in Business Information Management and Information Technology. Previously, he has held leadership positions in the world’s leading Business Information providers, including Managing Director of Thomson Reuters Asia, and General Manager of Dun & Bradstreet (D&B), Hong Kong and Taiwan. In addition, he personally managed Hong Kong's Commercial Credit Bureau while working with D&B, and the Consumer Credit Bureau through his directorship at TransUnion Limited. Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed