|

In December 1999, Jack Ma and 17 other founders released their first online marketplace, named "Alibaba Online". It is the world's largest online Business-to-Business trading platform for small businesses. Founded in 2003 by Alibaba Group, Taobao, is China's largest consumer online shopping platform. Back in 2003, most people in China did not have credit cards nor debit cards for online payment. If Alibaba wanted to grow its online retail business, it had to find a way to get paid. Is this how Alipay was born? The following statistics can help understand the situation at that time.

Obviously at that time, if Taobao wanted to grow its online retail business, it had to find a way for the consumers to pay. Besides the lack of online payment methods, buyers were skeptical if the online sellers were scammers. Under this growth pressure, Alibaba Group launched Alipay (in Chinese: 支付宝) in 2004 under a subsidiary, Ant Financial. It acts as a third-party online payment platform with no transaction fees. It also provides an escrow service, in which buyers can verify whether they are happy with the goods they have bought before releasing money to the seller. When smart phone took off in China, Alipay logically extended its payment function to mobile in 2009. By 2016, Alipay was processing 175 million transactions per day, 60% of which were completed through a mobile phone. Since Alipay is the first big-scale successful third-party payment service provider, it maintains its market leader position until today. WeChat was created by Tencent initially as a mobile messaging application in 2011, and was enabled with a mobile payment function in June 2013. In 2014’s Chinese New Year Eve, WeChat Pay (in Chinese: 微信支付) introduced a feature for distributing virtual red envelopes, modelled after the Chinese tradition of exchanging packets of money among friends and family members for new year greetings. This feature accelerated WeChat Pay’s user base from 30 million to 100 million users within a month. It was this enthusiasm promoted the acceptance of mobile payment to a scale that never happened before. By 2016, the volume of active credit cards in China is 465 million, or 340,000 per million people. These numbers signify that credit cards became popular. In addition, both Alipay and WeChat Pay can link to a credit card, an authorized bank account, or an independent e‑wallet. Why do Chinese consumers prefer to use mobile payment methods instead of credit cards? Compared to traditional payment methods, such as credit cards or debit cards, Alipay and WeChat Pay gained the preference of mobile users over time due to the following factors:

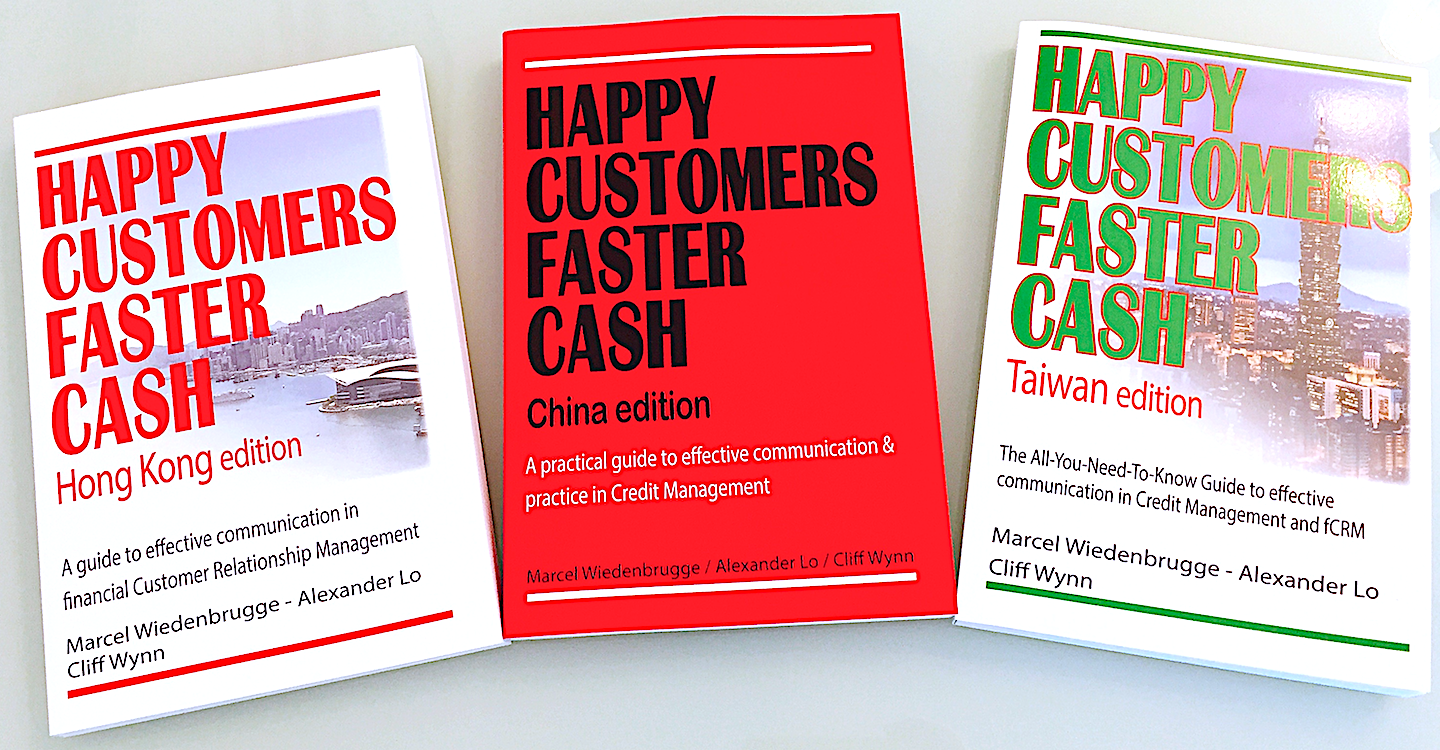

How widely does the public accept Alipay and WeChat Pay? In 2015, non-cash payments accounted for nearly 60% of retail transactions in China. Of all non-cash payments, Alipay and WeChat Pay captured 28% of all retail transaction fees; effectively what would have been nearly US$20 billion in payments fees on transactions had they been processed on traditional card payment networks. This Credit Insight is an extract from the book Happy Customers Faster Cash, China Edition and on sale at Amazon.

More companies sell on credit to their customers in China. This book shares with you, using statistical data, the true picture of payment behavior in China. It also contains lots of cultural insights for you to better understand the business environment in China. A chapter is dedicated to discuss various aspects of China company credit reports.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAlexander has over 25 years of experience in Business Information Management and Information Technology. Previously, he has held leadership positions in the world’s leading Business Information providers, including Managing Director of Thomson Reuters Asia, and General Manager of Dun & Bradstreet (D&B), Hong Kong and Taiwan. In addition, he personally managed Hong Kong's Commercial Credit Bureau while working with D&B, and the Consumer Credit Bureau through his directorship at TransUnion Limited. Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed