|

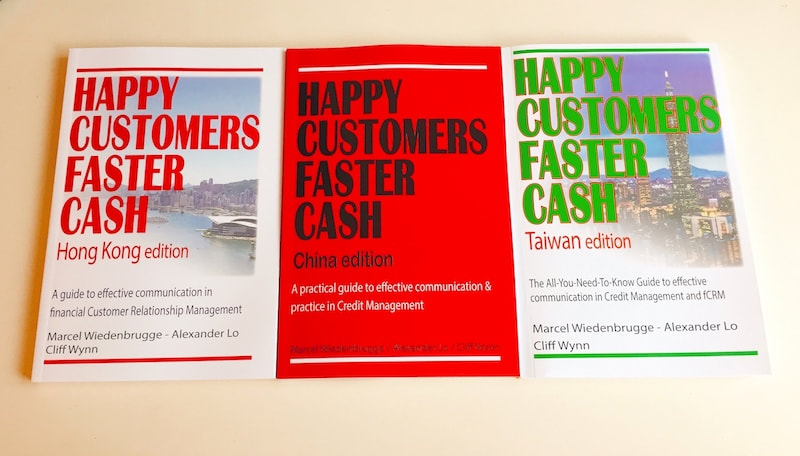

It is a known fact that it is not easy to obtain credit terms from Hong Kong companies. Any particular reason driving this credit practice? Does Hong Kong legal system helps to enforcing contracts fast? Why this must be taken into account when practicing credit management on Hong Kong based companies? In the report of “Doing Business 2018” published by The World Bank Group, Hong Kong ranked 28th in the Enforcing Contracts Index (1st being the best). The Enforcing Contracts indicator measures the time and cost for resolving a commercial dispute through a local first-instance court and the quality of judicial processes index, evaluating whether each economy has adopted a series of good practices that promote quality and efficiency in the court system in the areas of court organization, case management, court automation and alternative dispute resolution. In this index, Hong Kong is behind Korea, Singapore, China, Taiwan, Bhutan in Asia. This rank resulted from Hong Kong having a relatively higher cost as a percentage of the claim value. Also, Hong Kong scores lower in the quality of judicial processes index, that measures whether each economy has adopted a series of good practices in its court system in four areas: court structure and proceedings, case management, court automation and alternative dispute resolution. As a result, a simple reason that most Hong Kong companies do not like to give credit is because of the high litigation cost in Hong Kong. Even if you win a court case, the penalty for damages is not a common court practice in Hong Kong. Often the plaintiff cannot even recover its litigation cost after winning the case. Therefore, avoiding dispute is more cost effective than doing more business. The BaWang and Next Magazine case is a good case study to understand more about litigation in Hong Kong. In this case, Next Magazine was fined HK$3 million by the High Court for defaming BaWang International. The fine was less than 0.5 per cent of the HK$630 million in damages that BaWang International was seeking. Besides, Next Magazine also had to foot 80% of BaWang’s legal bill. This news is located in this link … This Credit Insight is an extract from the book Happy Customers Faster Cash, Hong Kong Edition and on sale at Amazon.

A guide to effective communication in financial Customer Relationship Management with a focus on compliance and credit management for Hong Kong companies. A chapter is dedicated to discussing various aspects of Hong Kong company credit reports. #HongKong #credit #CreditReport #FaBuTX

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAlexander has over 25 years of experience in Business Information Management and Information Technology. Previously, he has held leadership positions in the world’s leading Business Information providers, including Managing Director of Thomson Reuters Asia, and General Manager of Dun & Bradstreet (D&B), Hong Kong and Taiwan. In addition, he personally managed Hong Kong's Commercial Credit Bureau while working with D&B, and the Consumer Credit Bureau through his directorship at TransUnion Limited. Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed