|

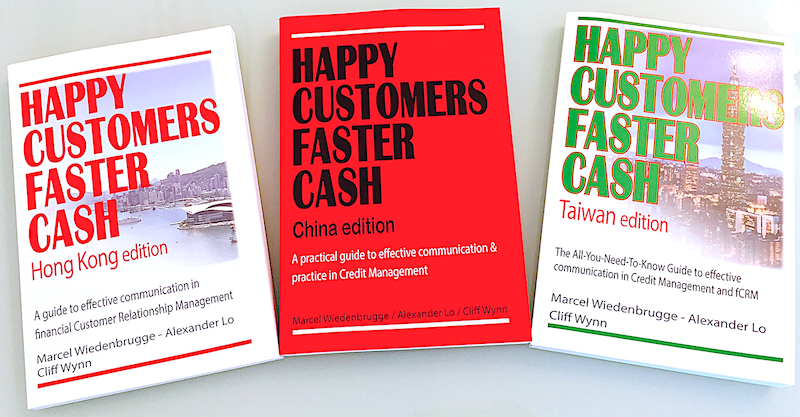

In Taiwan, if you have a chance to pay in a shop or restaurant, the cashier or waiter will ask you for your business' Government Uniform Invoice Number (GUIN統一編號) before he or she issues you a receipt with the restaurant's GUIN and your GUIN printed on it. This is because for a business to file a receipt as an expense and to deduct it from its profit tax, the receipt must have the business’ GUIN printed on it. In Taiwan, a company must report all revenue to the Taiwan tax authority. Government Uniform Invoice (統一發票) is the official value-added tax (VAT) invoice used in Taiwan. Companies must issue Government Uniform Invoices (GUIs) upon the sale of goods or services, for down payments, credit memos, debit memos, and sales returns, as stipulated in the Time Limit for Issuing Sales Documentary Evidence section of Taiwan’s Value-added and Non-value-added Business Tax Act. Shown on the right are two samples of Government Uniform Invoices. By legislation in Taiwan, every sales invoice, credit memo, debit memo, down payment document, and purchase or sales return document must have a GUI Number. This number’s purpose is to track all the value-added tax (VAT) that a company pays or collects, and so are crucial to the creation of a company’s VAT returns. Unlike in the Western economies, business invoices that a company usually prints out for their customers are not regarded as official invoices in Taiwan, although they can be considered as payment notices. Instead, Government Uniform Invoices are the ultimate official: the regional tax authorities assign unique numbers to groups of 100 or more to each company to be used in its GUIs, and these numbers must be used in a two-month period. This Credit Insight is an extract from the book Happy Customers Faster Cash, Taiwan Edition and it is now on sale at Amazon.

This book is a learning tool for people engaged in the credit process. It contains three extensive chapters about credit management, business culture and communication with the focus in Taiwan. A chapter is dedicated to discussing various aspects of Taiwan company credit reports.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAlexander has over 25 years of experience in Business Information Management and Information Technology. Previously, he has held leadership positions in the world’s leading Business Information providers, including Managing Director of Thomson Reuters Asia, and General Manager of Dun & Bradstreet (D&B), Hong Kong and Taiwan. In addition, he personally managed Hong Kong's Commercial Credit Bureau while working with D&B, and the Consumer Credit Bureau through his directorship at TransUnion Limited. Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed